Why Now Is Still a Great Time To Buy If You’re Ready With a Plan

If you’ve been paying attention to the headlines lately, chances are you’ve come across a lot of negativity around the housing market. Will prices crash? Are rates ever going to come back down? Is it even worth buying a home right now?

It’s easy to get caught up in the noise. But what often gets overlooked is the bigger picture.

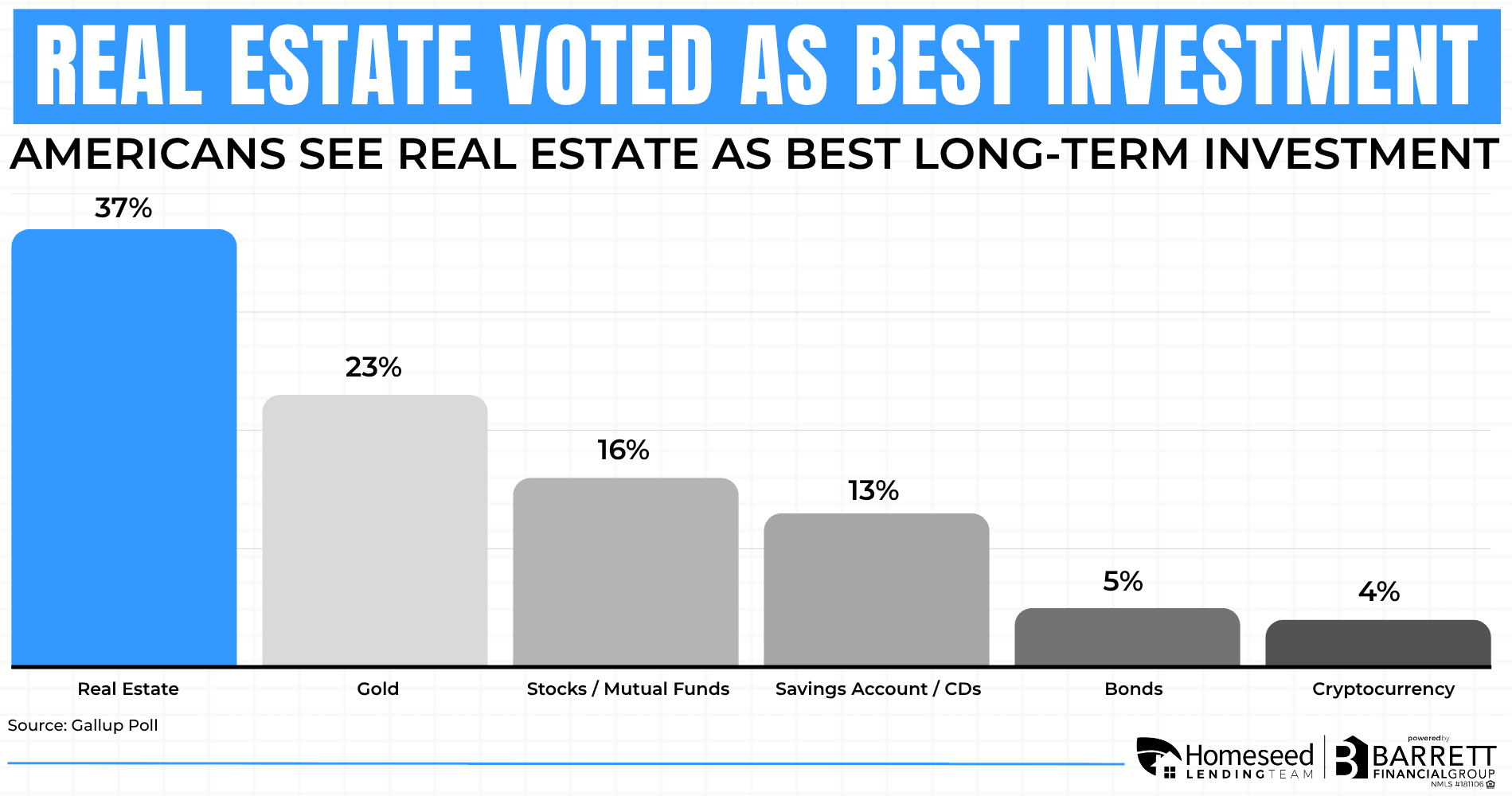

The truth is, real estate continues to be one of the most reliable long-term investments available. According to Gallup’s latest annual report, Americans have voted real estate as the best long-term investment for the 12th year in a row. That confidence doesn’t come from market hype. It’s based on decades of steady appreciation and wealth-building through owning real estate.

Home Prices Are Still Rising So Don’t Wait

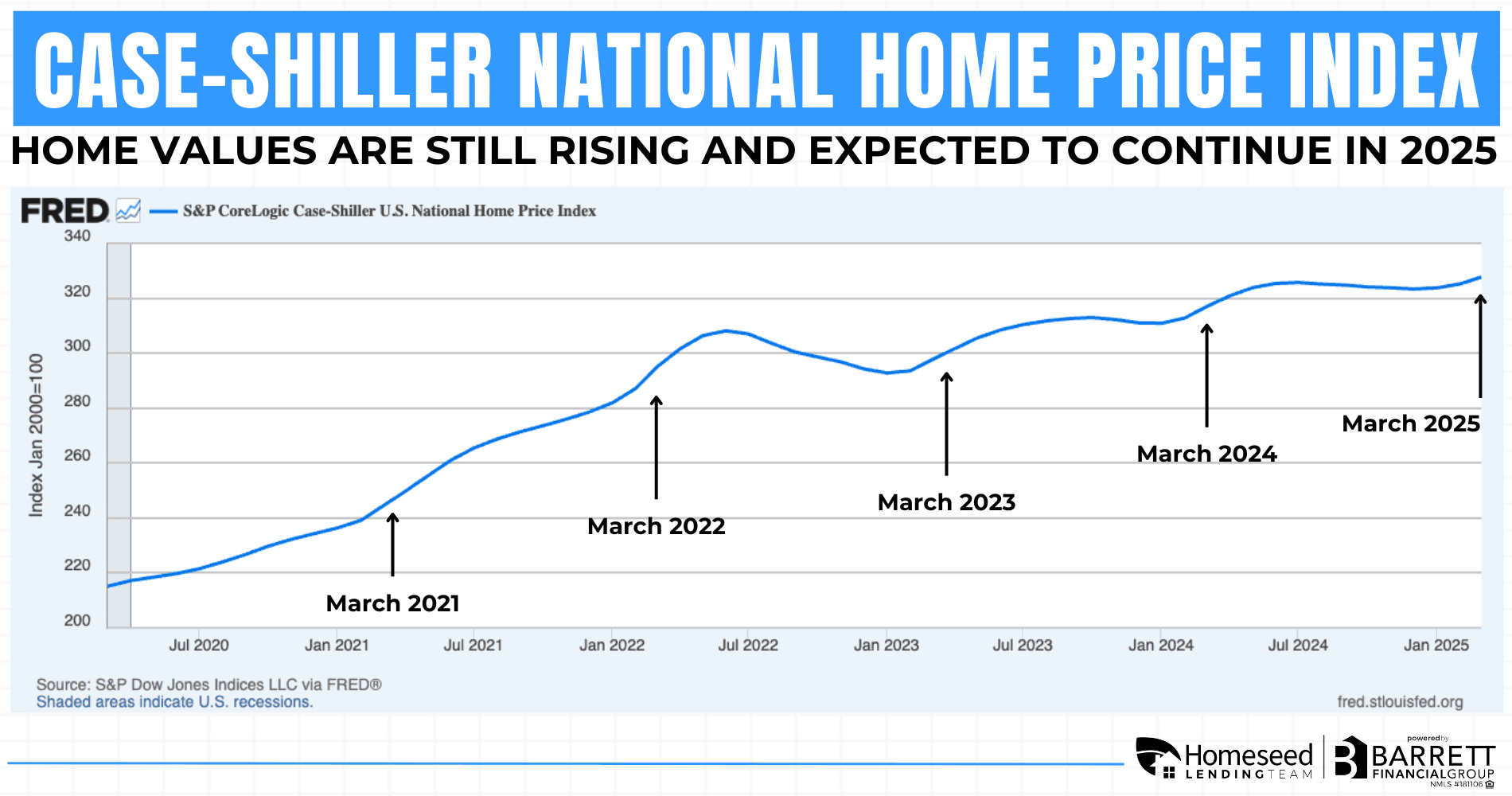

Despite media uncertainty, home values continue to rise across the country. According to the latest Case-Shiller U.S. National Home Price Index, home prices increased 3.4 percent in March compared to a year ago. The 10-city index rose 4.8 percent, and the 20-city index was up 4.1 percent year over year.

While annual growth has slowed slightly from earlier in the year, March still marked the strongest monthly price gains seen so far in 2025. Steady buyer demand continues to push prices higher in most metro areas, even as affordability challenges persist.

This trend underscores that real estate remains a solid long-term investment, with home equity continuing to grow despite short-term market shifts. And while it’s tempting to wait for interest rates to fall, doing so could backfire. When rates eventually decline, buyer demand will spike again. That means more competition, more bidding wars, and a higher chance of getting outpriced. These types of buying opportunities are usually limited to the slower winter months, but a unique combination of higher inventory and softening competition has created a rare window this summer. Jump in while the water’s warm.

More Inventory Means More Negotiating Power

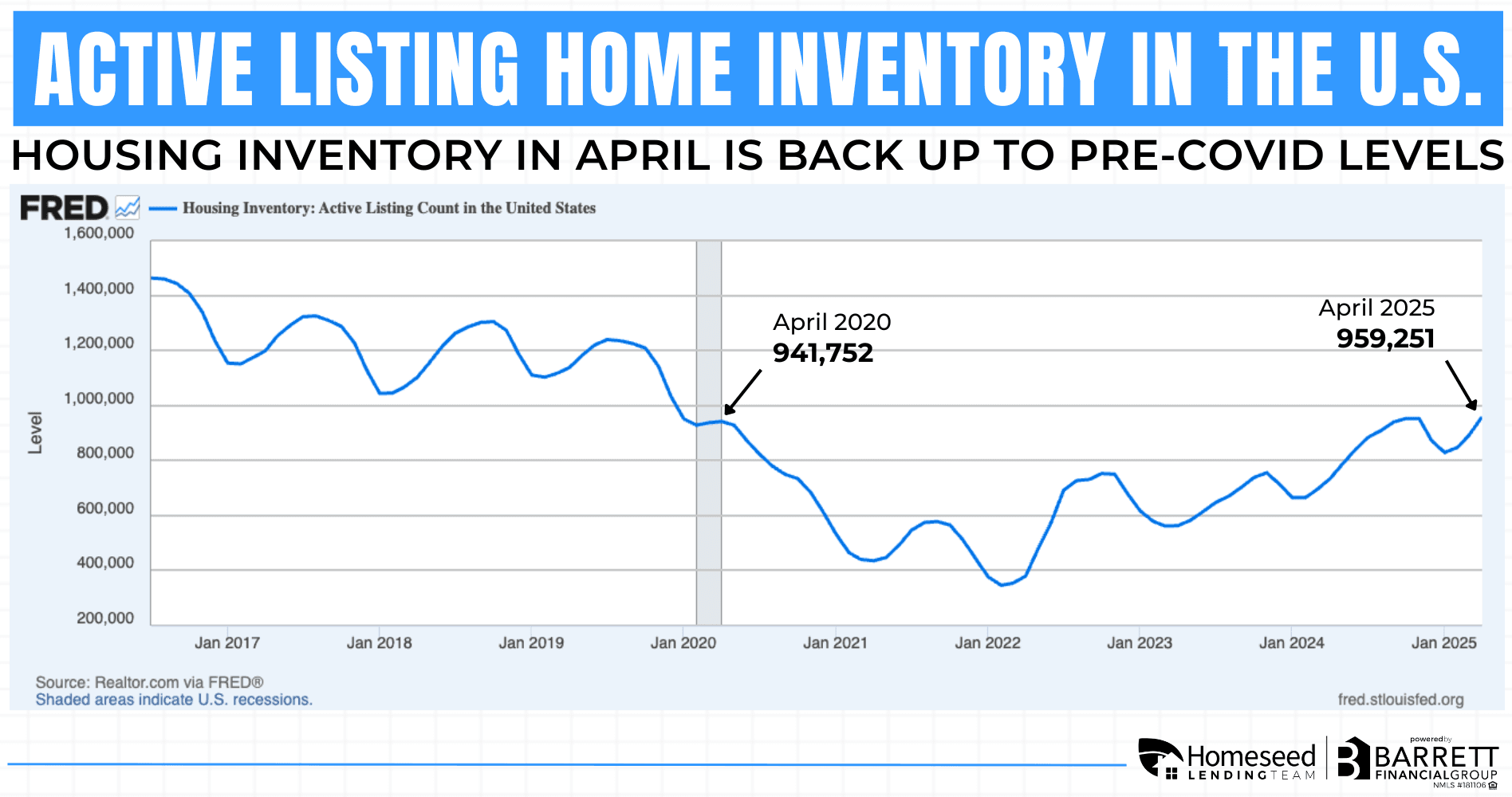

Inventory across the US is up nearly 20 percent compared to last year, marking the highest active listing count since the onset of COVID. This shift is giving buyers more options and easing the intense competition seen in previous years.

With more homes available, sellers are more open to negotiations. Many are offering concessions such as closing cost credits, rate buydowns, or repair allowances. These incentives can significantly reduce your cash-to-close or help lower your monthly payment when used strategically in your loan structure.

A Plan Is What Sets You Apart

In today's market, the most successful buyers are the ones who are prepared. Working with a mortgage advisor and a trusted real estate agent ensures you are not just shopping, but moving with purpose. Getting pre-approved before you start house hunting helps you understand your budget and makes your offer stronger. Sellers are more likely to accept offers from buyers who are ready to go and backed by a solid lending plan.

As independent mortgage brokers, we take this one step further. We run your unique scenario across our network of over 175+ lenders to ensure you get the most competitive options available. Whether your priority is the lowest possible rate, a flexible down payment solution, or creative financing terms, we’ll help you structure a strategy that supports your goals in owning real estate.

Reach out today and let’s talk about your goals to build a strategy that fits your situation.

Loan Originator

Barrett Financial | NMLS: 1635182