Understanding the 2025 AMI Limits: How They Impact Homebuyers, Sellers, and Real Estate Professionals

The recently released 2025 Area Median Income (AMI) limits are crucial figures that affect housing affordability, buyer eligibility, and overall market dynamics across the United States. While we'll illustrate using examples from counties in Washington State, the core concepts apply broadly wherever you live.

What Is Area Median Income (AMI)?

AMI represents the midpoint of household incomes for a particular geographic area, used by lenders, government agencies, and real estate professionals to determine eligibility for various homebuying programs, down payment assistance (DPA), and affordable lending products.

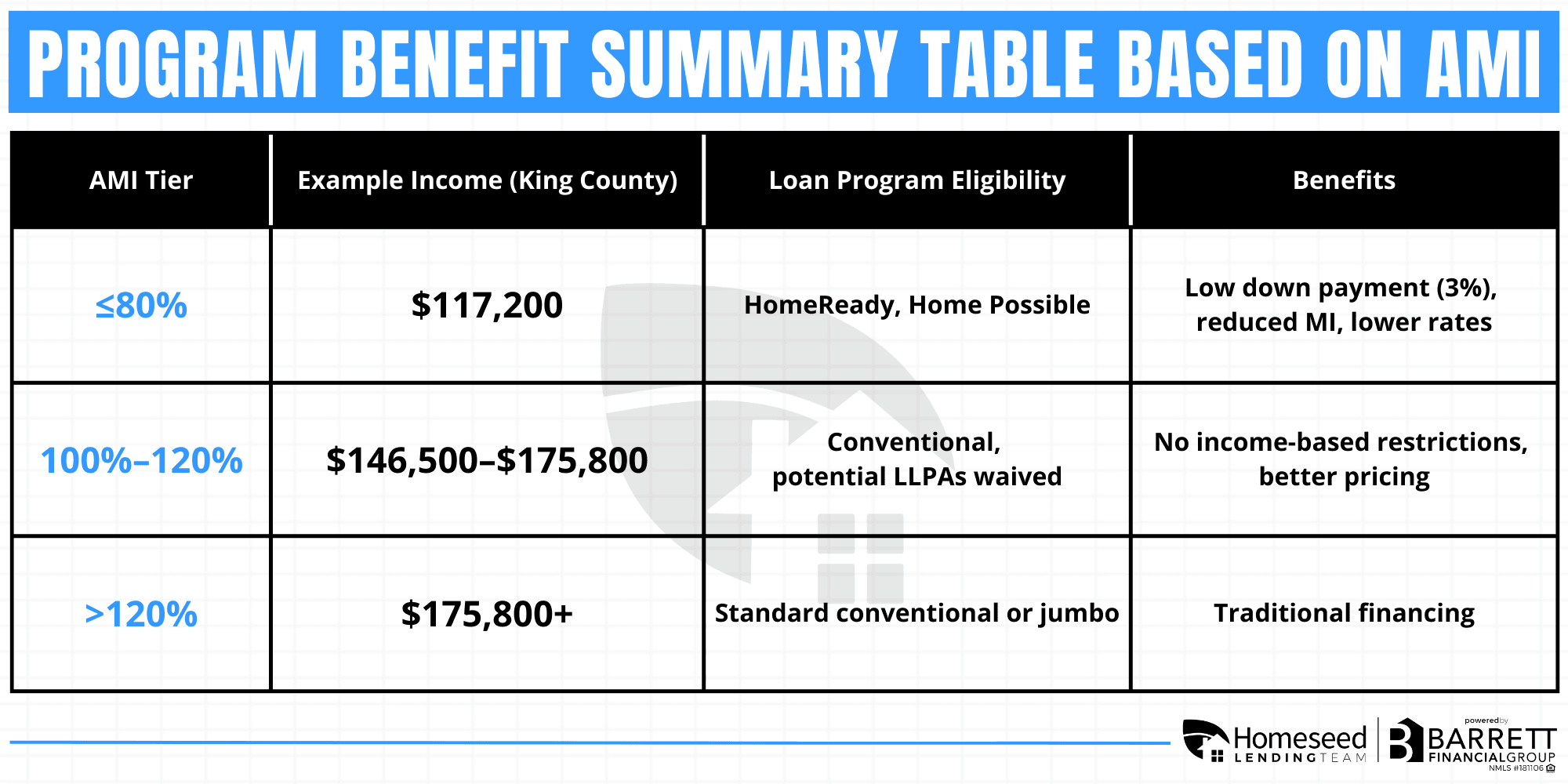

Common AMI levels include:

2025 AMI Limits: Washington State Examples

Let's look at examples from two distinct regions in Washington to highlight differences in affordability:

These thresholds guide buyers' eligibility for specialized loans and assistance programs.

How AMI Impacts Homebuyers

Implications for Sellers and Real Estate Professionals

Understanding AMI helps sellers and agents:

Educational Insights for Real Estate Market Participants

Real estate professionals can leverage AMI knowledge to better educate clients, anticipate market shifts, and ensure smoother transactions. Increased AMI limits typically translate to expanded affordability, potentially boosting market activity.

Take Advantage of the 2025 AMI Limits

Whether you're a prospective homebuyer, seller, or real estate professional, understanding the latest AMI thresholds equips you to make informed decisions. At Homeseed Lending Team, powered by Barrett Financial Group, we're dedicated to guiding you through these nuances.

Ready to explore your financing options, run a custom scenario, or discuss how these new limits affect your situation? Contact the Homeseed Lending Team today—we’re here to help seed your path to homeownership and market success.

Loan Originator

Barrett Financial | NMLS: 1635182