Adjustable-Rate Mortgages (ARMs): What You Need to Know

Considering your mortgage options? An Adjustable-Rate Mortgage (ARM) can offer strategic benefits depending on your financial goals and homeownership plans. Here’s a straightforward guide to help you decide if an ARM might be right for you.

What Is an ARM?

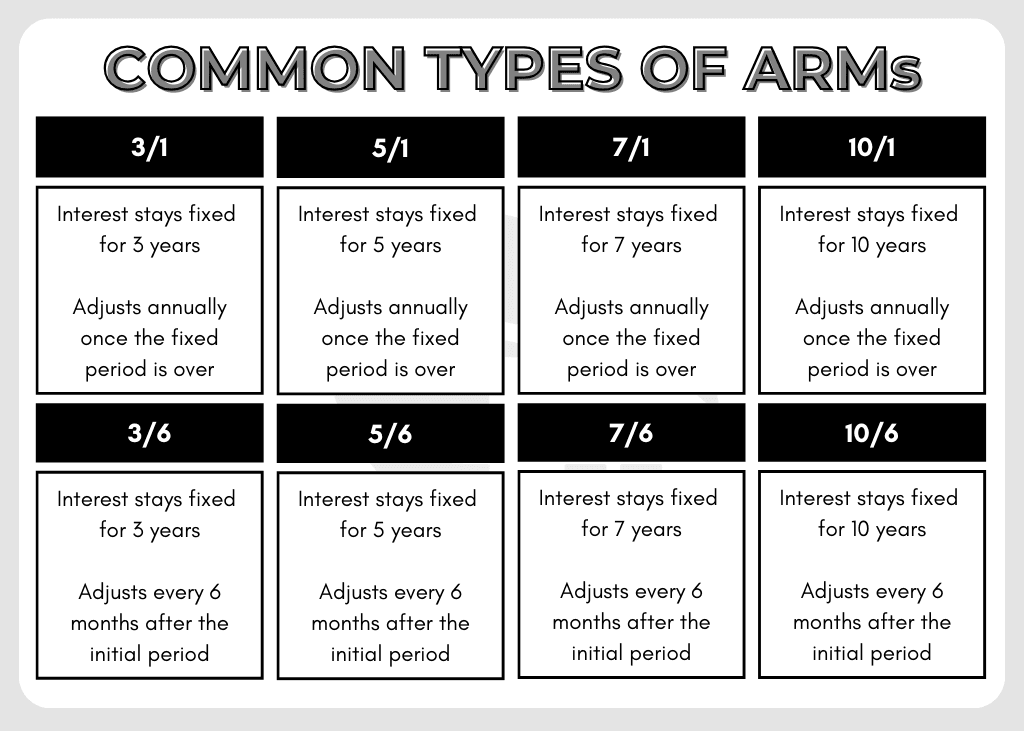

An ARM is a mortgage with an interest rate that starts fixed for an initial period (commonly 3, 5, 7, or 10 years), then adjusts periodically based on market conditions, typically tied to the Secured Overnight Financing Rate (SOFR).

How Does an ARM Work?

Example: 5/6 ARM Using SOFR

Initial Rate: Fixed at 6.25% for first 5 years

Index: SOFR (currently 4.35%)

Margin: 2.75%

Rate Caps: 2% first adjustment, 1% subsequent adjustments, 5% lifetime maximum

Rate Floor: 2.75%

After Initial Fixed Period (Year 6):

SOFR (4.35%) + Margin (2.75%) = 7.10%

With a 2% first adjustment cap, your maximum possible rate increase would be 8.25%.

Actual adjusted rate: 7.10%, rounded typically to 7.125%

Subsequent Adjustments (Every 6 Months):

Limited to 1% increase or decrease per adjustment period.

Lifetime cap prevents your rate from ever exceeding 11.25%.

If Rates Drop:

SOFR (2.00%) + Margin (2.75%) = 4.75%

Rate floor ensures your rate never falls below 2.75%

Why Consider an ARM?

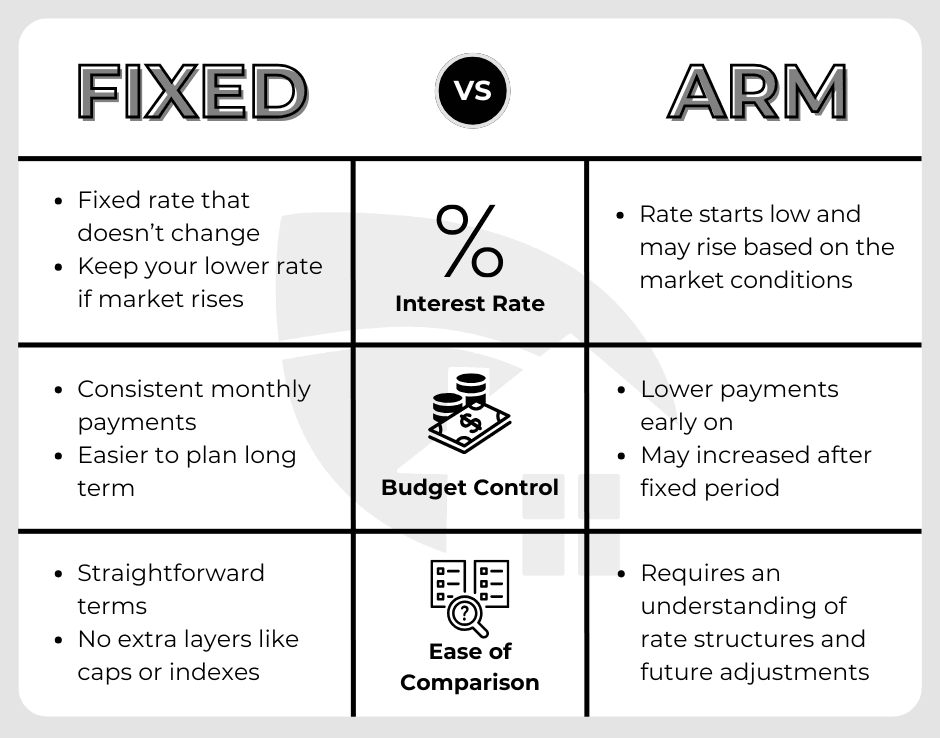

Lower Initial Rate: Often provides lower initial payments compared to fixed-rate mortgages.

Short-term Flexibility: Ideal if you anticipate selling, refinancing, or paying off the loan within the fixed period.

Potential Savings: Great if you expect your income to increase or want short-term financial breathing room.

Is an ARM Right for You?

ARMs can be advantageous if:

You plan short-term ownership.

You expect to refinance before adjustments begin.

You anticipate future income growth.

You prefer immediate lower payments and can manage potential adjustments.

Ready to Plan?

As the housing market accelerates, having a clear financing strategy is crucial. Let's discuss your options and create a customized mortgage plan aligned with your goals, ensuring you're ready to move decisively when the perfect home becomes available.

Loan Originator

Barrett Financial | NMLS: 1676877