2025 Summer Market Update: A Turning Point for Buyers and Homeowners

The second quarter of 2025 brought a welcome dose of optimism to the housing and mortgage markets. After a slower start to the year, we’re now seeing conditions tilt more favorably for buyers, current homeowners looking to refinance, and real estate professionals helping clients navigate their options.

Here’s what you need to know about the evolving market landscape and how it could benefit you.

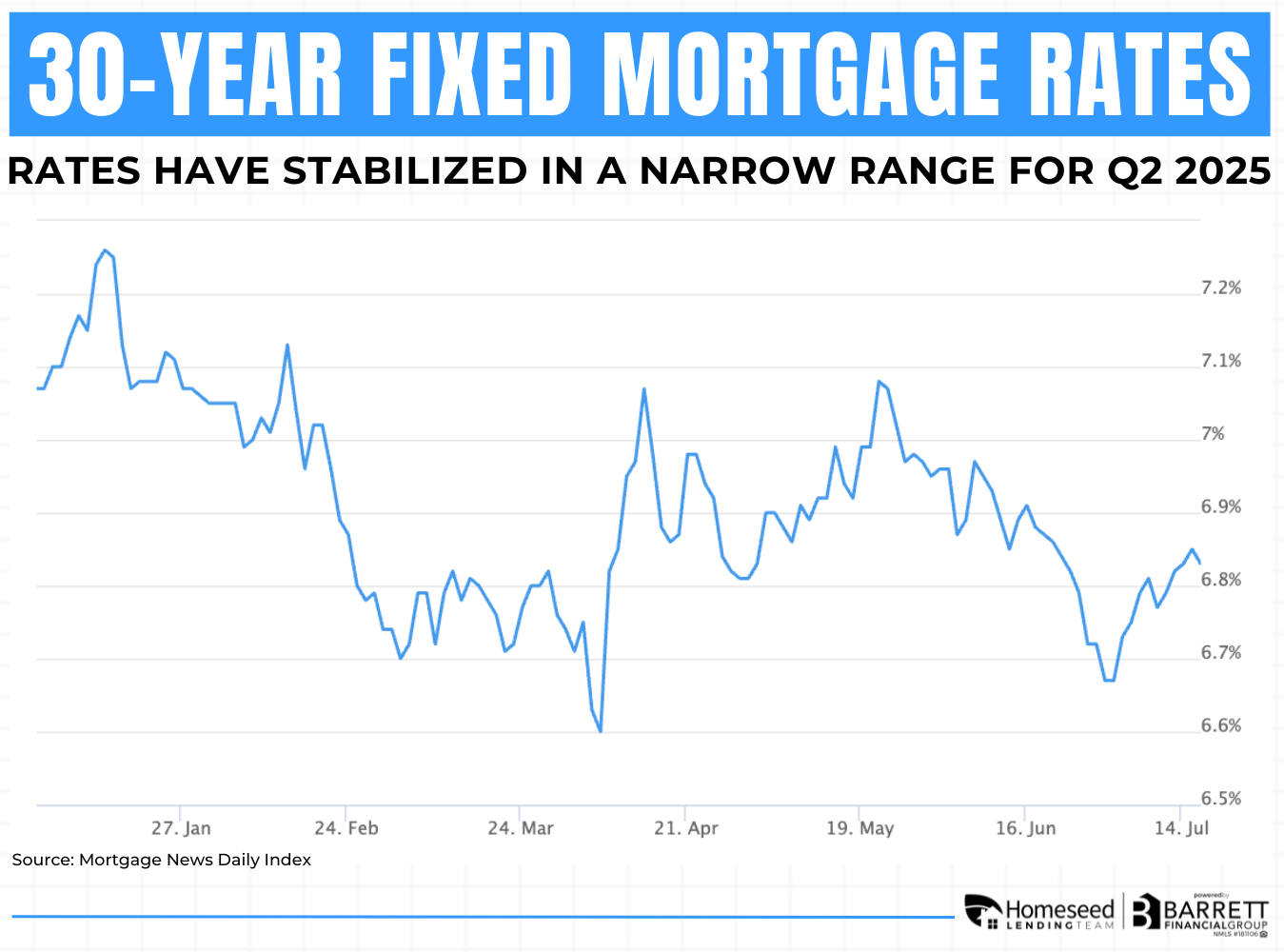

Rates Are Stabilizing, Creating More Predictability for Buyers

The 30-year fixed conventional mortgage rate started 2025 above 7% but trended downward through the end of Q1 as inflation cooled and market sentiment improved. In Q2, rates remained relatively stable, fluctuating within a narrow range between the mid to high 6% range.

· The lowest point occurred in early April, providing a temporary window of improved affordability.

· While short-term volatility remains, overall rate movement has been much more contained compared to the rollercoaster of 2022 and 2023.

· Markets are now watching closely for signs of Fed policy changes and further inflation data that could push rates lower in the second half of the year.

This rate stability is giving buyers and refinancers more confidence to move forward, knowing they can plan around a more predictable borrowing environment.

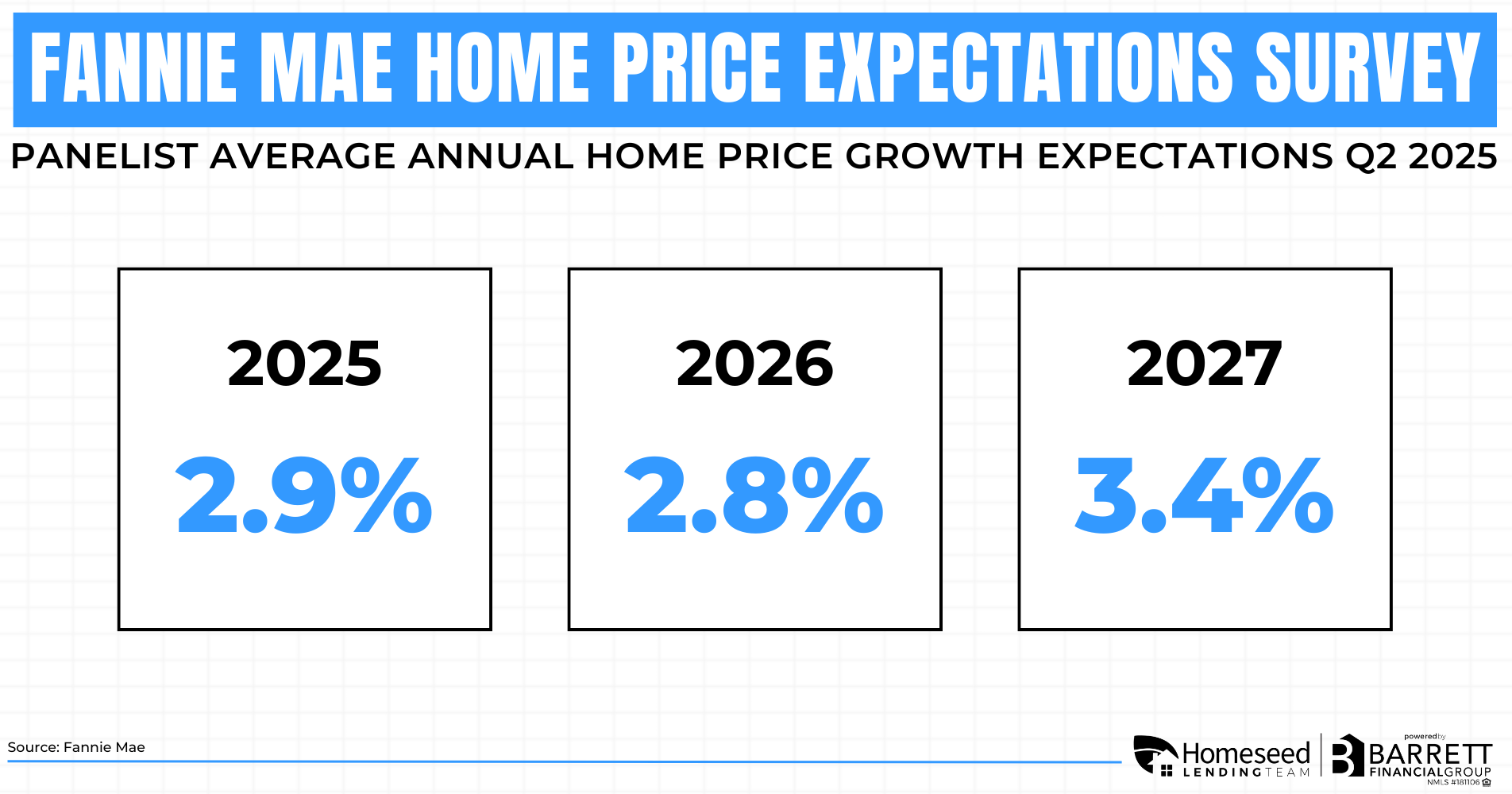

Home Price Appreciation Remains Resilient

While home prices are no longer rising at the rapid pace seen during the pandemic-fueled boom, they are still climbing steadily. National appreciation continues to reflect a healthy and sustainable market, supported by strong household formation, limited housing supply, and improving consumer confidence.

· According to Fannie Mae's Q2 2025 Home Price Expectations Survey, experts project home prices will rise by an average of 2.9% in 2025, followed by 2.8% in 2026 and 3.4% in 2027

· The latest Case-Shiller Home Price Index reported a 2.7% annual increase as of the April reading, showing that prices are still growing at a solid pace despite higher mortgage rates earlier this year

· CoreLogic and other analysts agree that home values are expected to increase over the next five years, with no major declines forecasted by most housing economists

For homebuyers and homeowners, this reinforces the long-term value of owning real estate. Even in a more balanced market, appreciation remains a powerful wealth-building tool that can support equity gains, future upgrades, and financial stability.

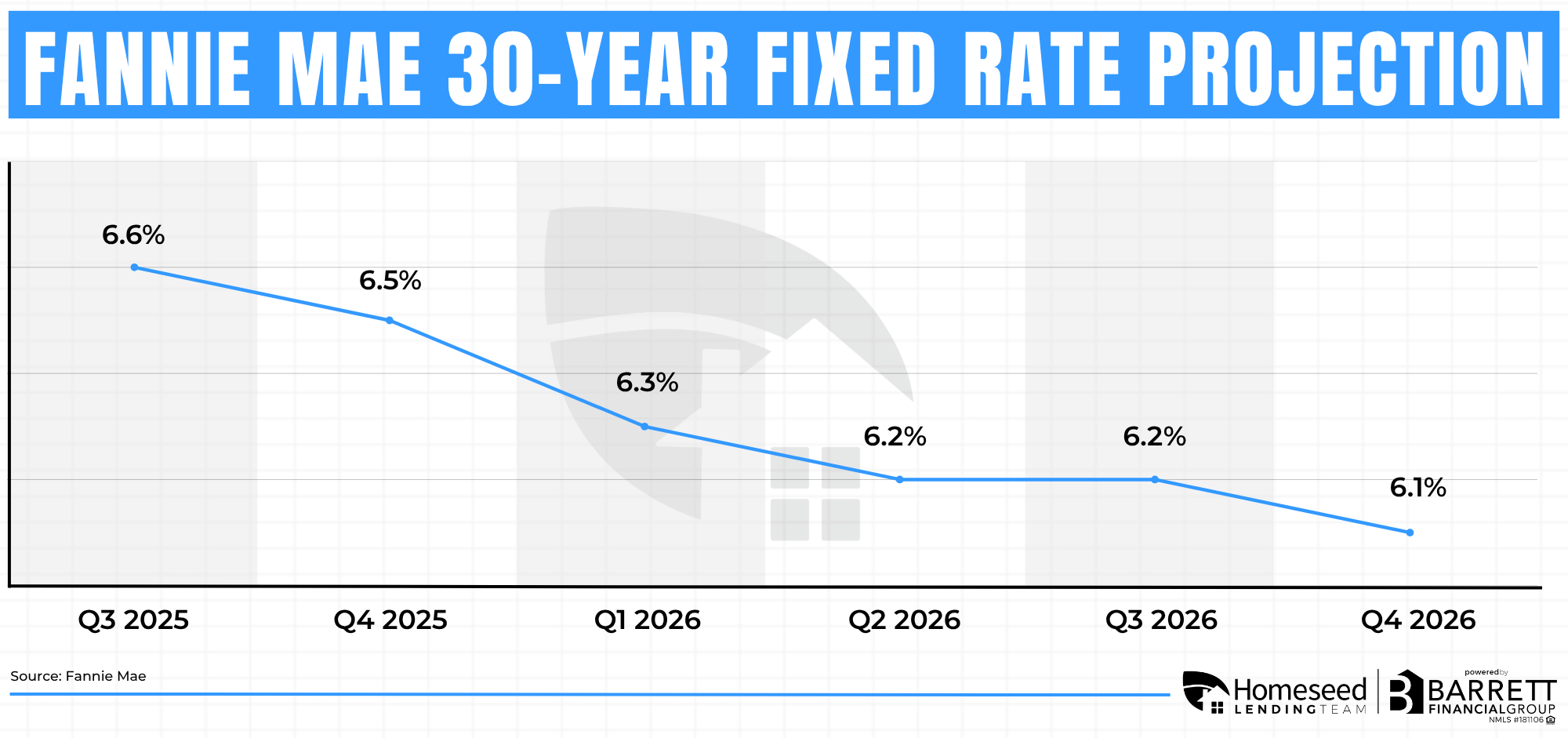

Refinance Activity Picking Up as Rates Ease

While most existing mortgages still hold lower rates from the 2020–2021 cycle, there’s a growing pool of homeowners who can now benefit from a refinance:

As rates are expected to drift downward in Q3, even more refinance opportunities may open up, especially for homeowners who bought in 2022 or early 2023.

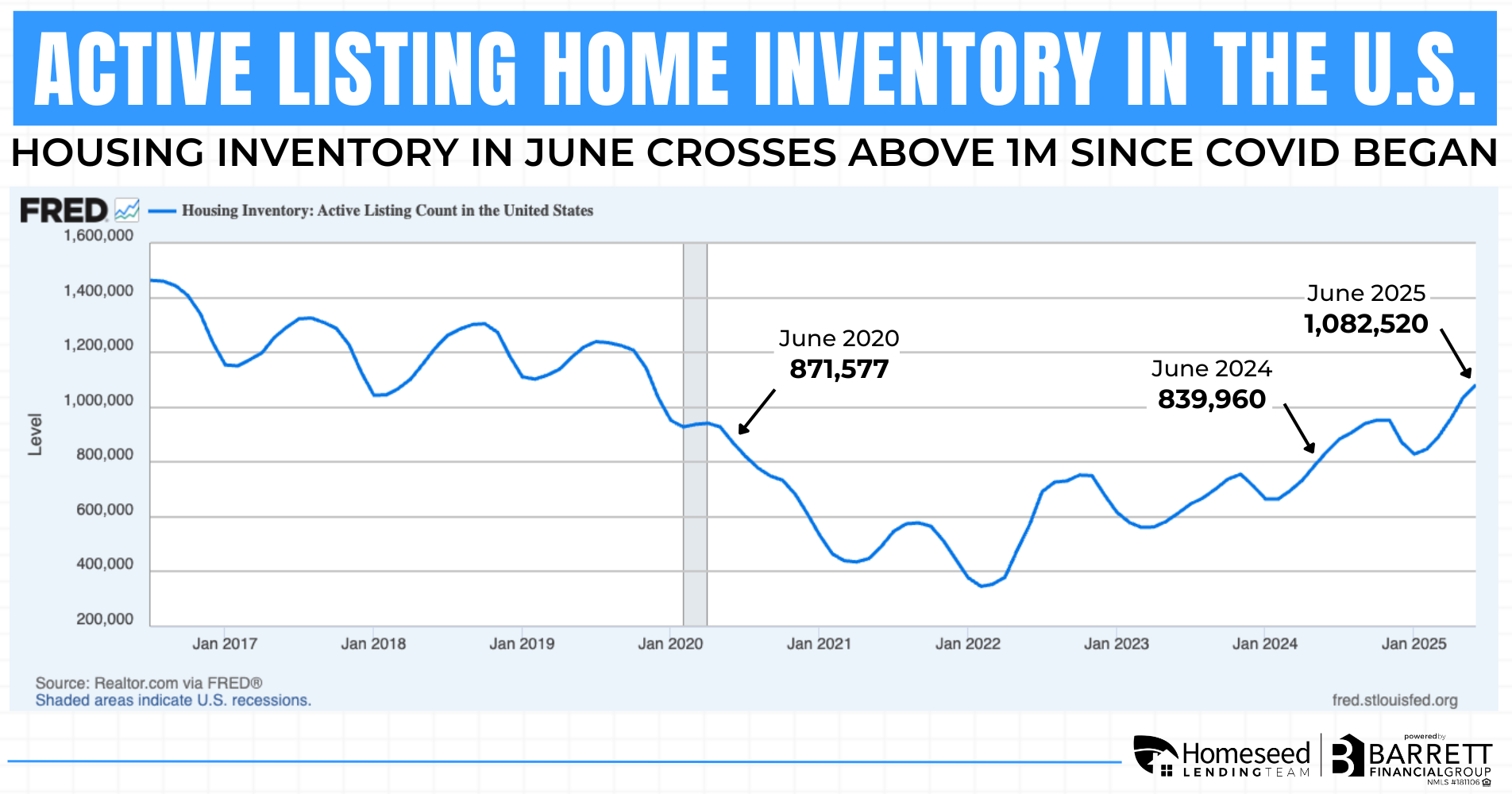

Inventory is Growing, Offering More Options for Buyers

Housing inventory made solid gains in Q2, helping to ease some of the supply constraints that have challenged buyers in recent years. As of June 2025, active listings reached 1,082,520 units, up 4% from May and 29% higher than the same time last year.

· The market now holds a 4.6-month supply of homes, moving closer to a balanced level.

· Homes are spending slightly less time on the market, averaging 27 days compared to 29 in April.

· First-time buyers accounted for 30% of purchases, showing that improving inventory is creating more opportunity for entry-level buyers.

This consistent increase in available homes, along with more stable mortgage rates, is giving buyers renewed confidence to act. For sellers, a larger pool of active buyers means more competition and better positioning with the right pricing and marketing strategy.

Key Takeaways

The second quarter marked a turning point. Lower rates, improved inventory, and resilient consumer confidence are combining to create new opportunities for both homebuyers and homeowners.

Whether you’re looking to purchase your first home, upgrade into a better space, or explore refinancing options, the remainder of 2025 is shaping up to be much more favorable.

If you're thinking about buying, refinancing, or just want to explore what’s possible in today’s market, let’s connect. We’re happy to help you review your options and create a plan that works for you.

Loan Originator

Barrett Financial | NMLS: 1691573