As a borrower, you always search for the lowest possible rate, hoping to pay less to borrow money. For instance, when you're shopping around for a mortgage, you're likely to choose a lender offering the lowest rate.

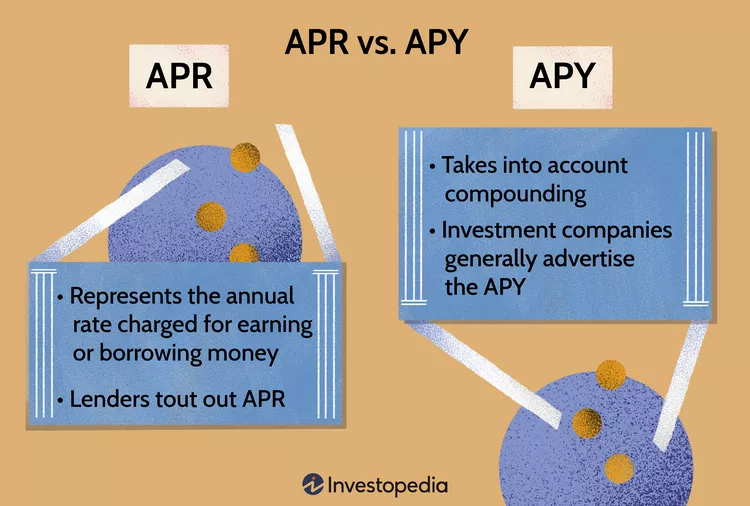

Banks often quote you the annual percentage rate on the loan or credit card. But, as we've already said, this figure does not consider intra-year compounding of the loan if you don't pay it off. It can compound daily, semi-annually, quarterly, or monthly.A bank may quote you a loan's interest rate of 5%, 7%, or 9% depending on the compounding frequency but you may pay a much higher rate. The quoted figure doesn't account for the effects of compounding but it does account for fees and other costs.

Suppose you were to consider the effects of monthly compounding as APY does. You will pay 0.38% more on your loan each year in this case, a significant amount when you amortize your loan over a 25- or 30-year period as you would with a mortgage

Loan Originator

Barrett Financial | NMLS: 195551