Homeownership is often seen as a key part of the American Dream, but it represents much more than just having a place to call your own. It’s a powerful investment, a way to build wealth over time, and a foundation for financial security. Understanding the long-term value of homeownership can help you make informed decisions that benefit you for years to come. Let’s explore how you can maximize your investment in a home and uncover the numerous advantages it can provide.

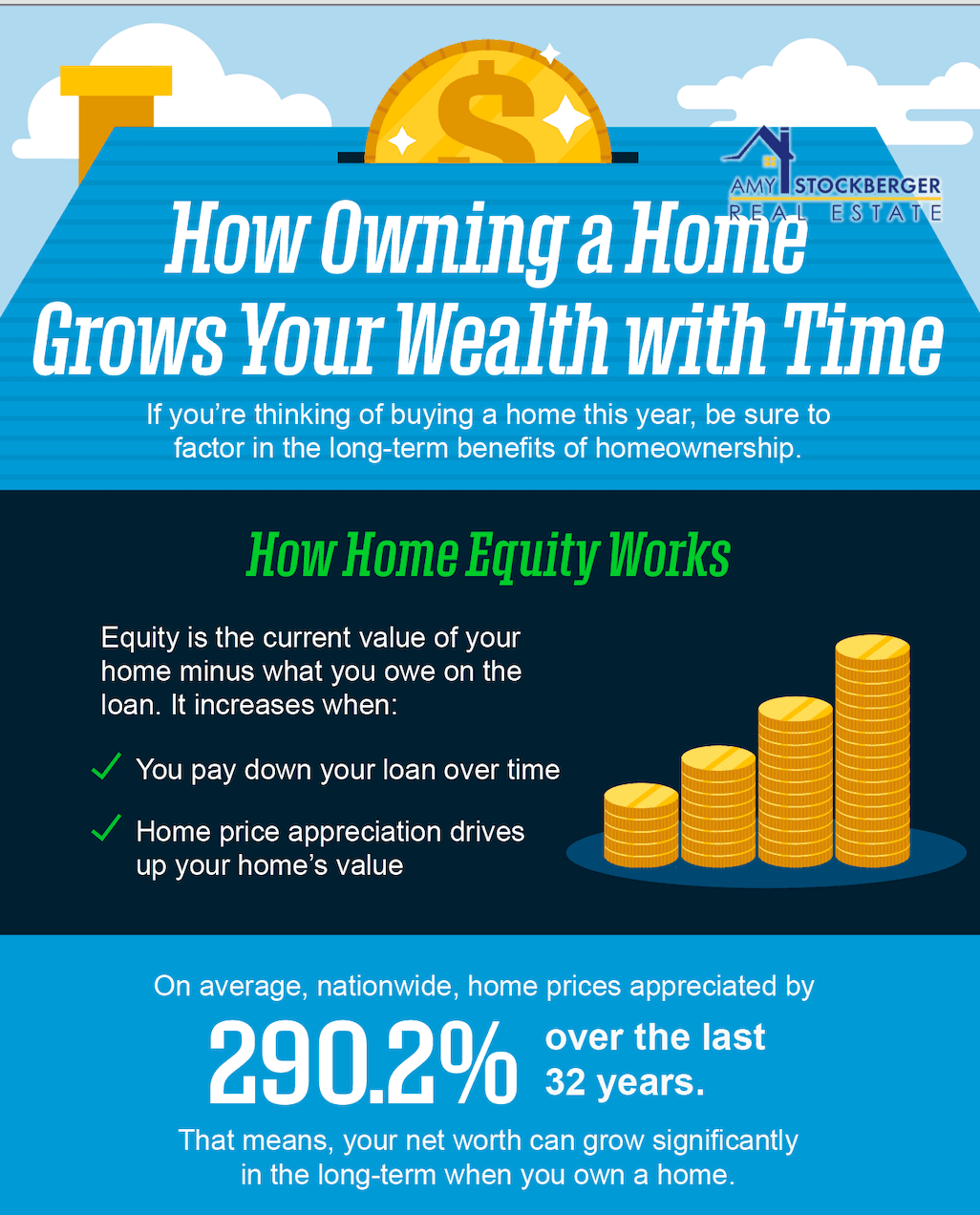

First, let’s talk about the appreciation of property values. Over time, homes generally increase in value. While there can be fluctuations in the real estate market, owning a home typically leads to a significant increase in equity. Equity is the part of your home that you truly own, and it grows as you pay down your mortgage and as your home’s value rises. This means that instead of paying rent, which doesn’t contribute to your wealth, you’re building equity that can serve as a financial resource in the future. This appreciation can provide you with substantial benefits down the line, whether it’s through the sale of your home, a refinance, or a home equity loan.

Another major advantage of homeownership is the tax benefits that come with it. Many homeowners can deduct mortgage interest and property taxes from their federal income taxes, which can lead to significant savings. This tax advantage can be an excellent incentive, allowing you to keep more of your hard-earned money. Moreover, many local and state governments offer additional tax incentives for homeowners, which can provide further financial relief. It’s always wise to consult a tax professional to fully understand the benefits you may qualify for based on your specific situation.

In addition to financial benefits, owning a home can provide stability. Homeownership often leads to a sense of community and belonging. When you own your home, you’re more likely to invest in your neighborhood, whether that means getting to know your neighbors, participating in community events, or contributing to local initiatives. This engagement can create a more enriching environment for you and your family, fostering relationships and connections that can last a lifetime.

Now, let’s discuss the flexibility and control that comes with being a homeowner. When you rent, you often have to conform to the rules set by your landlord. This can limit your ability to personalize your living space or make improvements that suit your lifestyle. As a homeowner, you have the freedom to renovate, decorate, and modify your home as you see fit. Want to paint the walls a bold color? Go for it! Thinking about installing new countertops? You can do that too. This level of control allows you to create a space that truly feels like home, aligning with your personal taste and needs.

When considering your investment in a home, it’s also important to think about the impact of inflation. Real estate has historically been a strong hedge against inflation. As prices rise, so do home values, which means that your investment can outpace inflation over time. This characteristic makes homeownership a reliable part of a long-term financial strategy, especially during uncertain economic times.

To maximize your investment, consider making improvements to your home. Strategic upgrades can significantly enhance your property’s value. Focus on updates that offer the best return on investment, such as kitchen remodels, bathroom upgrades, or energy-efficient improvements. These enhancements not only improve your quality of life but can also increase your home’s market value significantly when it comes time to sell.

Furthermore, regular maintenance is vital in preserving your home’s value. Simple tasks such as keeping up with landscaping, performing routine repairs, and ensuring your home remains energy efficient can prevent larger issues from arising down the road. A well-maintained home will not only retain its value but may also appreciate more quickly than one that is neglected.

For those who may be new to the home-buying process, it’s essential to educate yourself on the various types of mortgage options available. Understanding your choices regarding fixed-rate, adjustable-rate, and government-backed loans can help you select a mortgage that aligns with your financial goals. A knowledgeable mortgage professional can guide you through these options and help you find a solution that fits your unique circumstances.

As you embark on your journey toward homeownership, setting clear financial goals is crucial. Determine what you can comfortably afford, taking into account not just the mortgage payment, but also taxes, insurance, and maintenance costs. This comprehensive understanding will empower you to make sound decisions throughout the home-buying process.

Don’t hesitate to reach out to a mortgage professional who can help you navigate these considerations. They can assist you in understanding your financial landscape and what you realistically can afford. This partnership is vital to ensuring you make a wise investment that aligns with your long-term goals.

Furthermore, if you’re already a homeowner, consider reviewing your mortgage regularly. Life circumstances change, and so do financial markets. Refinancing could be a great option if it can lead to better terms or lower monthly payments. Keeping an eye on your mortgage can help you optimize your financial situation as time goes on.

Lastly, stay informed about your local real estate market. Understanding trends in your area can provide valuable insight into the long-term value of your home. Are new developments being built nearby? Is there a growing job market in your region? These factors can contribute to increasing property values and enhance your investment.

In summary, the long-term value of homeownership is immense. From building equity to enjoying tax benefits, creating stability, and having control over your living space, the advantages are clear. By making informed decisions and staying proactive about your investment, you can position yourself for success.

If you’re ready to explore your options or have specific questions about your situation, I encourage you to reach out. I’d love to help you navigate your journey toward homeownership and ensure you maximize your investment for the long term.

Loan Originator

Barrett Financial | NMLS: 195551