When it comes time to buy a home, choosing the right lender is one of the most important decisions you will make. Your lender can significantly affect your loan experience, from the types of loans available to the overall process of getting your mortgage. Understanding the differences between banks, credit unions, and mortgage brokers will help you make an informed choice that aligns with your needs and financial goals.

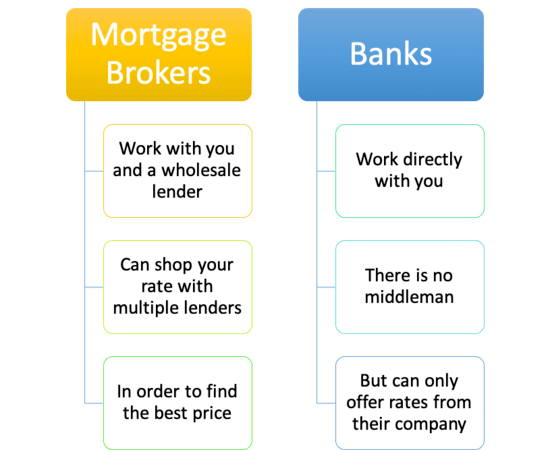

First, let’s talk about banks. Banks are well-known financial institutions that offer a wide range of products and services, including mortgages. One of the main advantages of using a bank for your mortgage is their stability. They are generally larger institutions with established reputations. This can give you peace of mind knowing you are working with a recognized entity. Banks also offer a variety of loan products, which can be beneficial if you are looking for something specific, like a fixed-rate mortgage or an adjustable-rate mortgage.

However, getting a mortgage through a bank can sometimes be a more rigid experience. Banks often have strict qualifying criteria, which might make it harder for some borrowers to get approved. This can be especially challenging for first-time homebuyers or those with less-than-perfect credit. Additionally, larger banks may not provide the same level of personal service that smaller institutions can. If you’re someone who values a more personalized approach, that might be something to consider.

Now, let’s discuss credit unions. Credit unions are not-for-profit organizations that serve their members. This often means that they can offer lower fees and better interest rates than traditional banks. When you work with a credit union, you are essentially working with a community-focused lender. They tend to have a more personalized approach, and members often report feeling more valued than they do at larger banks.

One potential downside to credit unions is that they may have fewer mortgage products compared to banks. This might limit your options if you have specific needs or if you are looking for a unique type of loan. Additionally, not everyone can join a credit union; they often have membership requirements based on location, profession, or other factors. If you qualify, though, a credit union could be an excellent choice for your mortgage needs.

Next up are mortgage brokers. A mortgage broker acts as an intermediary between you and various lenders. They can provide you with access to a wide range of loan products from multiple lenders, which can be particularly helpful if you are looking for competitive rates or specific loan features. Working with a broker can also save you time, as they do much of the legwork for you.

However, it’s important to note that mortgage brokers are paid through commissions, which might add to your overall costs. While they can help you find the best deal, you should ensure that you fully understand any fees involved upfront. This makes it essential to have open communication about costs and to ask any questions you might have.

When deciding on which type of lender to use, it's vital to consider your specific circumstances and needs. Are you a first-time homebuyer? Do you have unique credit circumstances? Understanding your situation can guide you toward the best type of lender.

Here are a few suggestions to help you in your decision-making process:

1. Assess Your Financial Situation: Take a close look at your credit score, income, and overall financial health. Knowing where you stand will help guide your choice of lender. Different lenders may have varying requirements, so having this information at your fingertips can streamline the process.

2. Think About Personal Service: How important is it for you to have a personal relationship with your lender? If you value one-on-one interactions and personalized service, you might lean more towards credit unions or smaller banks. On the other hand, if you are comfortable with a more transactional relationship, a larger bank or a mortgage broker may suit you just fine.

3. Explore Loan Products: Make sure to understand the types of loans offered by each lender. If you have a specific type of mortgage in mind, like a FHA loan or a VA loan, ensure the lender you are considering can provide it. This will save you time and effort in the long run.

4. Evaluate the Process: Some lenders are known for having smoother, more efficient application processes than others. Do a bit of research on the lenders you are considering to see if they have a reputation for excellent service. This can make a significant difference in your experience.

5. Understand the Fees: Don’t forget to ask about any fees associated with your loan. Different lenders have different ways of structuring their fees, so it’s crucial to get all the details before making a decision. Knowing what you will be paying helps prevent any surprises down the road.

6. Consider the Future: Think about how long you plan to stay in your new home. If you are buying a starter home, a different type of loan might be more suitable compared to a long-term residence. Understanding your future plans can influence your decision on the type of mortgage and lender you choose.

7. Seek Guidance: The mortgage process can be complicated, and everyone’s situation is unique. Don’t hesitate to reach out to a knowledgeable mortgage loan officer to discuss your specific needs. They can provide insights tailored to your situation, helping you navigate the options available.

Choosing the right lender is a crucial step in your home-buying journey. Whether you decide to go with a bank, credit union, or mortgage broker, take the time to evaluate your options. Each type of lender offers distinct advantages and potential drawbacks. By understanding these differences and considering your unique needs, you can make a more informed choice.

If you have any questions or would like to go over your specific needs, please reach out! I'm here to help you navigate this important decision and ensure you find the best lender for your mortgage journey.

Loan Originator

Barrett Financial | NMLS: 195551