In today's global marketplace, the real estate industry is more interconnected than ever. With international buyers increasingly interested in purchasing property in the United States, there's a unique opportunity for local real estate agents like you to expand your business and serve a diverse clientele. One effective way to attract these buyers is through foreign national mortgages, which are specifically designed for non-U.S. residents. Understanding this financing option can not only enhance your business but also help your clients achieve their dreams of owning property in America.

Foreign national mortgages are loans specifically tailored for foreign buyers looking to invest in U.S. real estate. These loans can open doors to new possibilities, both for you as a real estate agent and for your clients who are seeking investment opportunities or second homes in the States. The key to successfully connecting with international buyers lies in your ability to understand their unique needs and offering mortgage solutions that cater to their situations.

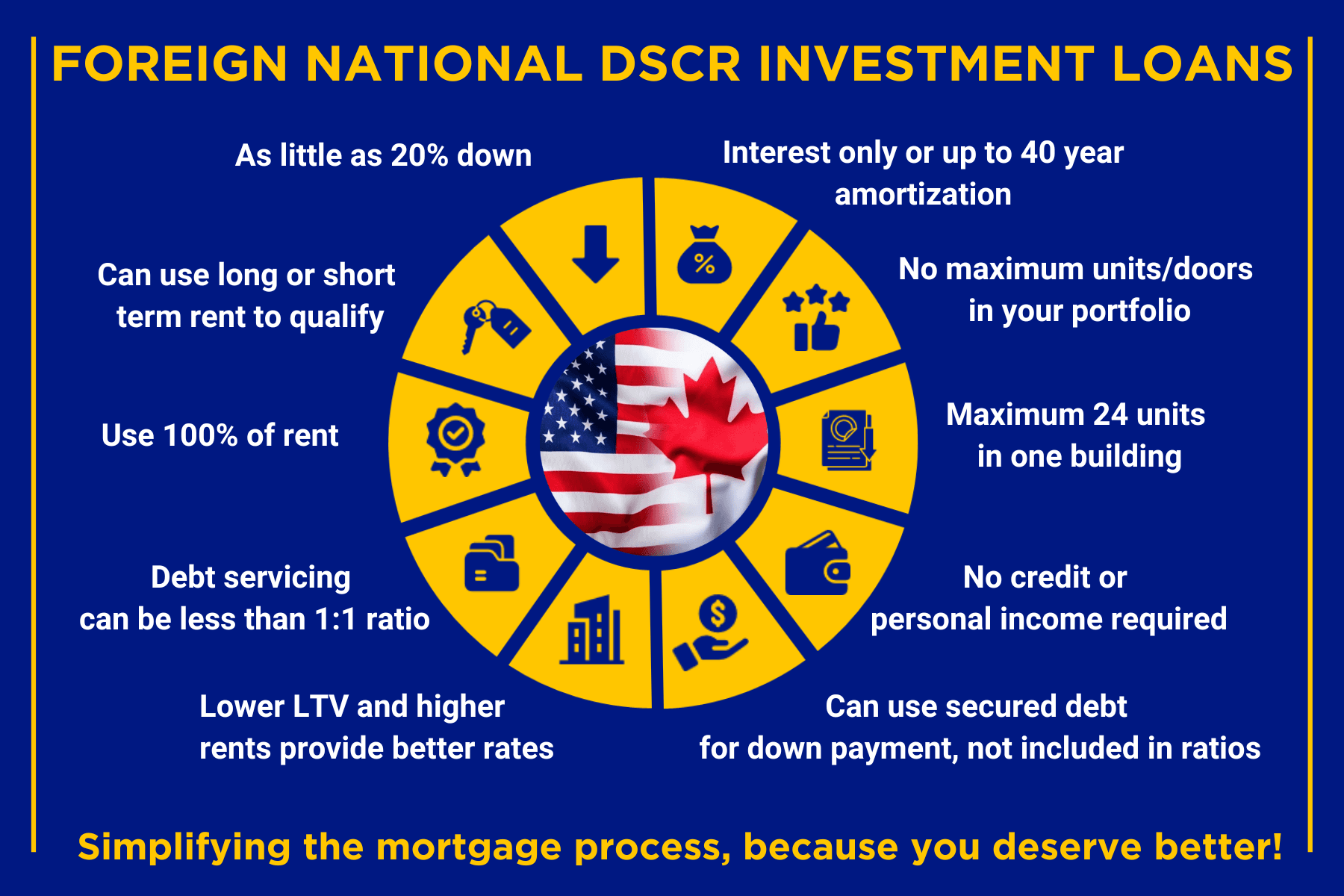

Many foreign buyers may not be familiar with the U.S. mortgage process, so it's essential to be their guide. Start by educating yourself about the specific requirements and benefits of foreign national mortgages. Typically, these loans allow buyers to secure financing with less stringent documentation compared to traditional mortgages. While the requirements can vary based on the lender and the borrower’s country of origin, many foreign national mortgage programs focus on the property itself rather than the borrower’s credit history. This can be a significant advantage for international buyers who may not have an established credit score in the U.S.

It’s also important to recognize the different reasons international buyers may choose to invest in U.S. real estate. For some, it’s about securing a vacation home or a rental property. For others, investing in U.S. real estate might be part of a larger strategy for financial diversification or establishing a presence in the U.S. market. As you connect with these buyers, understanding their motivations can help you tailor your approach and recommendations.

One common misconception among real estate agents is that foreign buyers are only interested in high-end luxury properties. While some certainly are, many international buyers are looking for a range of options, including single-family homes, condos, and investment properties in various price ranges. By broadening your focus and showcasing a variety of properties, you can attract a wider array of international clients.

Building relationships with international buyers starts with effective marketing. Consider translating your marketing materials or your website into other languages to make it easier for foreign buyers to understand your offerings. Additionally, using social media platforms and online advertising targeted at specific countries can help you reach potential clients where they are. Highlighting the benefits of owning property in the U.S. and sharing success stories of other international buyers can go a long way in building trust and interest.

Networking is also an essential part of attracting international buyers. Attend international real estate conferences or local events where you can meet potential clients and other professionals in the industry. Establishing connections with foreign real estate agents can lead to referrals and partnerships. Collaborating with professionals who specialize in foreign national mortgages can provide you with the knowledge and resources needed to assist your clients effectively.

When dealing with international buyers, cultural sensitivity is crucial. Different cultures have varying expectations regarding communication, negotiation, and the home buying process. Be prepared to navigate these differences and be respectful of your clients’ preferences. Taking the time to learn about the cultural backgrounds of your clients can significantly enhance the buying experience and build lasting relationships.

As you work with foreign buyers, clear communication is key. Make sure your clients understand the entire mortgage process, including any potential challenges they may face. Offering to help them find reliable local services, such as property management or legal assistance, can also add value to your service. By being a resourceful partner, you’ll establish yourself as a trusted advisor in their home buying journey.

In addition to understanding foreign national mortgages, it's important to stay informed about any changes in regulations and policies that could impact international buyers. Immigration laws, tax implications, and foreign exchange rates can all play a significant role in a buyer's decision to invest in U.S. real estate. Regularly updating your knowledge on these topics will allow you to guide your clients more effectively.

When presenting foreign national mortgage options to your clients, make sure to highlight the benefits that come with these loans. For example, many programs allow for lower down payments compared to traditional financing, which can be appealing to buyers who want to maintain liquidity. Additionally, these loans often have flexible qualifying criteria, which can be a game changer for clients who may not have a standard financial profile.

Another aspect to consider is the potential for investment growth in certain U.S. markets. By sharing insights and data on local real estate trends, you can help your clients make informed decisions about where to invest. Whether they are interested in high-growth areas, rental income potential, or simply a desirable location, providing this information can help instill confidence in their choice to purchase property in the U.S.

It’s also wise to develop a strong follow-up strategy. After initial conversations, reach out to your international clients periodically to keep them engaged. Whether it’s sharing market updates, new listings that may interest them, or simply checking in to see how they are doing, maintaining contact can keep you top-of-mind. This proactive approach can lead to repeat business, referrals, and long-term partnerships.

Finally, the best way to truly understand how to serve international buyers is to learn from them. If you have the opportunity, seek feedback about their experience in the home buying process. What challenges did they face? What could have made their experience smoother? By listening to their insights, you can continuously refine your approach and offer better service to future clients.

If you're ready to take your business to the next level and learn more about how foreign national mortgages can benefit you and your clients, I encourage you to reach out. Together, we can explore specific strategies tailored to your needs and ensure you’re well-prepared to cater to the growing market of international buyers. Let’s connect and unlock new opportunities for your real estate business!

Loan Originator

Barrett Financial | NMLS: 195551